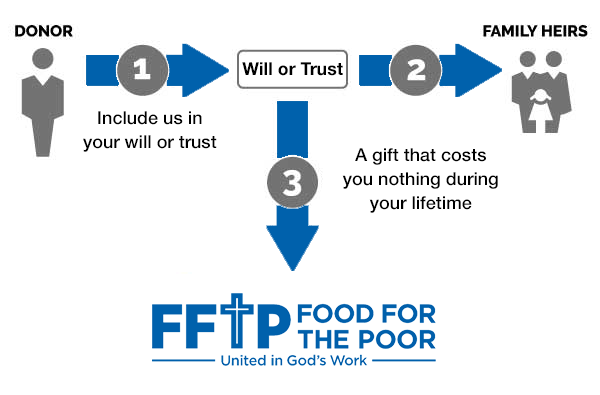

Gifts in a Will

Making a legacy gift in your will or trust is one of the easiest and most popular ways to make a lasting impact through Food For The Poor. Once you have provided for your loved ones, we hope you will consider making our mission part of your life story through a legacy gift.

A gift in your will is one of the easiest ways to create your legacy and offers the following benefits:

- Lasting Impact: Your gift will create your legacy of transforming the lives of those in need.

- Flexible: You can alter your gift or change your mind at any time and for any reason.

- No Cost: It costs you nothing now to give in this way.

(infographic: click to view larger)

Four simple, “no-cost-now” ways to give in your will

General gift

A general bequest is a gift of a specific amount.

Residuary gift

Specific gift

A specific gift is a gift of a particular piece of property. For example, real estate, funds in a bank account or shares of a corporation.

Contingent gift

You can mix these no-cost ways together. For example, you might consider leaving a specific percentage (such as 50%) of the residual to Food For The Poor contingent upon the survival of your spouse.

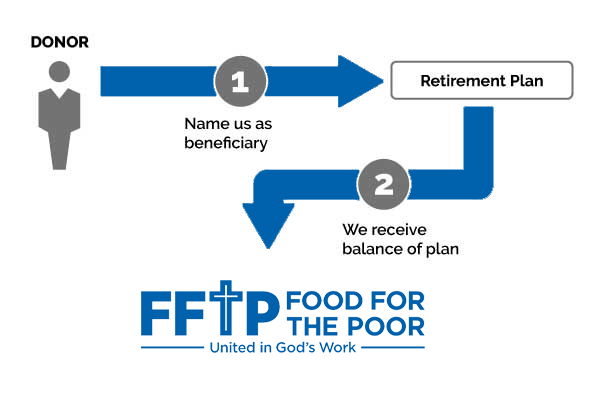

Gifts by Beneficiary Designation

It’s easy to put your bank accounts, retirement funds, savings bonds, and more to use in helping to end poverty — and it costs you nothing now. By naming Food For The Poor as a beneficiary of these assets, you can power our mission for years to come and establish your personal legacy of supporting families living in poverty.

Potential benefits of gifts by beneficiary designation:

- Reduce or eliminate taxes

- Reduce or avoid probate fees

- No cost to you now to give

- Create your legacy with Food For The Poor

(infographic: click to view larger)

Types of Gifts

Retirement plan assets

You can simply name Food For The Poor as a beneficiary of your retirement plan to help those living in poverty.

Life insurance policies

You can name Food For The Poor as a beneficiary of all or a portion of your life insurance policy. With this gift arrangement, Food For The Poor will receive the proceeds of your policy after your lifetime. You can change your beneficiary at any time and may reduce your estate taxes.

Bank or brokerage accounts

This is one of the easiest gifts to give and one of the most useful in accomplishing your philanthropic goals. The next time you visit your bank, you can name Food For The Poor (Tax ID: 59-2174510) as the beneficiary of a checking or savings bank account, a certificate of deposit (CD) or a brokerage account. When you do, you’ll take a powerful step toward helping the materially poor and renewing the poor in spirit for generations to come.

Funds remaining in your donor-advised fund

What remains in a donor-advised fund is governed by the contract you completed when you created your fund. When you name Food For The Poor as a “successor” of your account or a portion of your account value, you enable people in need to achieve their full potential.

How to update a beneficiary designation:

Simply contact your bank, retirement plan administrator, insurance company or other financial institution to request a beneficiary designation form. You may also be able to log in to your account and update your beneficiaries online.

Please use our legal name: Food For The Poor, Inc.

Include our tax identification number: 59-2174510

Please let us know so we can ensure that your wishes are carried out.